What Others Say About Us

Stock Options Calculator:

Analyze Markets and Calculate Your Investment Profits

A stock options calculator can be an integral asset to your trading strategy. Thanks to this simple tool, you can calculate potential profits and assess the risks of different investments. It’s the crucial information you need to make informed investment decisions. See how you can use a stock options value calculator to your advantage and become an expert in using this market tool to identify the best trading decision.

Step-by-Step Guide to Using Our Stock Options Calculator

You don’t have to be tech-savvy to use a stock options profit calculator. The tool is designed to be user-friendly. The information it provides is useful to both beginners and expert investors. Follow these steps to use the tool right away:

-

1

You can pick between a call or put option. The first step is to choose the stock market options calculator type. The selection will depend on your preferred investment.

-

2

Pick the option’s expiration date. You will see the little calendar button where you can choose the exact day, month, and year. Entering the date is optional and won’t affect the results.

-

3

Insert the strike price. The next step is to enter the strike price of your asset in the stock options trading calculator. Make sure to be precise since this is a crucial parameter for the results.

-

4

Enter the number of contracts. This number will influence the total potential cost and profit displayed by the tool.

-

5

Set the option’s price. As you enter the price of the option, you will notice that the stock options price calculator displays the total cost. The tool will perform automatic calculations by multiplying the number of contracts by the option price.

-

6

Enter the current stock price. Check out the stock price at the current moment and enter it into this field.

-

7

Insert the estimated stock price at expiration. You can now enter the expected stock price at the expiration point. Once you enter it, you can click calculate.

-

8

Check out the results. The stock trade options calculator will now display the total return on your option. The data includes the total predicted return on the option, along with the percentage of your potential profit or loss.

It’s crucial to underline that you can use the stock options probability calculator an unlimited number of times. Don’t hesitate to enter different parameters to see how the results change. It will help identify the best possible option terms for the desired deal.

Overview of Stock Options Calculators

A stock options premium calculator is a tool investors use to predict the potential profit or loss on option contracts. The tool relies on you to enter the basic parameters, and it does the calculations based on those data. You will receive useful information about the probable expected profit at the contract expiration.

The benefits of using an options stock calculator are the following:

- 1 Automatic option assessment. You don’t have to do the calculations yourself. Instead, you just enter several parameters and get the results — voila!

- 2 Easy to use. Even if you are a total newbie to the investment world or computers, you’ll feel right at home using a stock calculator for options.

- 3 Compare multiple investment options. You can see the predictions regarding which stock will perform better. That will help you pick a more suitable investment.

- 4 It’s free. Most calculators are complimentary, meaning you’ll never have to pay a single cent to use them.

Understanding the Fundamentals of Stock Options

A stock option is a contract that provides you with the right to purchase or sell a particular amount of a company’s stock at a specific price and before the given expiration date. It’s not mandatory to act on the contract. You don’t have an obligation to buy or sell the asset. The only thing you get with the stock options contract is the right to do that. Investors often use stock options in their trading strategies due to flexibility. Option contracts can be a useful way of managing your portfolio in a way that maximizes potential profit. However, it’s still necessary to pick the right assets, and that’s where a calculator for stock options comes into play.

Call Options Explained

-

Strike Price and Market Scenario 39-48 42-50. A strike price is the asset value you’re targeting for purchasing or selling. Let’s say you buy a call option of a stock that’s worth $48. You believe its value will increase to $50, so you make $50 the strike price and buy that option.

-

-

-

Option Premiums and Cost Calculations. The option premium is the sum you pay to buy the call option. Let’s say that it’s $1 per share. If you buy 1 contract with 100 shares, the cost will be 100 x 1 = $100. You can use a stock profit calculator to calculate costs and your potential profits automatically.

-

Price Fluctuations and Time Value. Each asset on the stock market has a fluctuating value. Those fluctuations will affect your call option’s price, too. The cost will depend on how much time there is until the expiration and the intrinsic worth. Options calculator stock comparisons can help you decide on the most suitable contract.

-

-

-

Calculating Profit Potential. Let’s say you purchased an option at $48 with a strike price of $50. The asset reached $55 before the contract expiration date. Its value is $5 over the strike price. It might be a good time to sell the asset at this point, or you can risk waiting for the stock to go up more to increase your profit further.

-

Risk Management and Capped Losses. You might buy an option with a strike price of $50. The expiration date comes, and the asset never reaches that value. If that happens, your contract becomes worthless. However, you paid the premium that limits your maximum loss.

-

Real-Life Examples of Put Option Outcomes

A put option is a specific investment in the stock market. You purchase this contract to grant you the right to sell the stock under the given conditions. It’s the opposite direction of the call option. If you get a put option contract, you expect the underlying asset to lose its value to a certain point. In other words, you need a bearish market for this to happen. If the asset meets the conditions specified in the deal, you can go ahead with the sale.

-

The stock price at expiration is $51: this is your break-even point.

The stock price is above $51 at expiration: you make a profit beyond your costs.

-

The stock price is below $50 at expiration: the option becomes worthless, and you lose the $100 spent on it.

The stock is in the range of $50.01 to $50.99 at expiration: you have partial losses from the $100 spent on the option.

You find a stock currently worth $51. The analysis you performed indicates that the asset could lose value in the coming few months.

Purchase a put option with a strike price of $50. Based on your investment decision, you buy a put option. The strike price is $50, indicating that’s the lowest the asset must reach before you can sell it.

Execute cost calculations to see if it’s profitable. You pay the put option premium of $1 per share, so if you buy 100 shares, the total cost is $100. This is great to protect your losses since this is the maximum sum you can lose on this option.

Put Option Calculator Explained

Our stock options calculator app also offers the opportunity to calculate the potential profits of your put option contracts. The tool works the same way as for call options. Here’s a short guide:

-

Choose the put option on the homepage. This is important to ensure that our stock screener options calculator does the right math.

-

-

-

Enter the necessary details. Pick the expiration date for example 1 month, strike price $30, and the number of contracts you buy.

-

Calculate the costs. You also need to enter the current stock price $33.

-

-

-

Evaluate possible outcomes. The estimation of its worth at the expiration date $30 or lower.

-

Check out the results. Once you click the Calculate button, the tool will display the results regarding the expected returns on options.

-

Scenarios for Put Option Outcomes

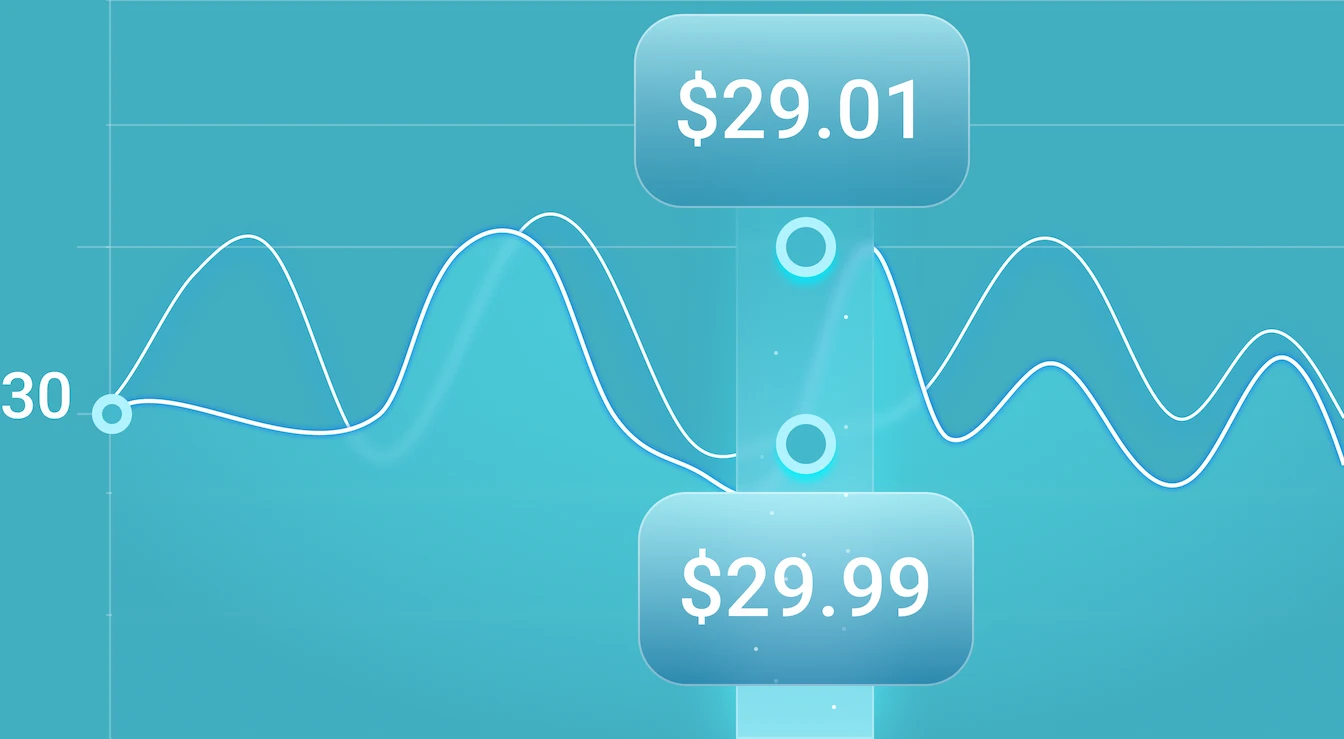

We’ve taken the example where the current stock price is $33 while the strike price is $30. Now, let’s talk about the different scenarios that could happen with this put option contract.

-

The stock price is $29 at expiration: this is your break-even point.

The stock price is below $29 at expiration: you make a profit beyond your costs.

-

The stock price is above $30 at expiration: the option becomes worthless, and you lose the $100 spent on it.

The stock is in the range of $29.01 to $29.99 at expiration: you have partial losses from the $100 spent on the option.

Stock Price Falls Below $30. You’ve targeted $30, but the asset value went down to $26. That makes the intrinsic value of your investment $4 per share. You get this if you do the simple math because 30 - 26 = 4. You did purchase the put option for $1 per share, so your revenue is $3 per share. If you bought 100 shares, you earned $300 in this deal.

Stock Price Stays Above $30. The specifics of the put option include the term that the stock must drop to at least $30 for you to sell it. Unfortunately, this means you can’t use that right in this trade. It means that the put option contract is worthless. Due to the loss limitation with the premium, you mitigated your risks and only lost the premium paid in this transaction.

Stock Price Between $32 and $33. Here’s a specific case that happens if the value of your asset is exactly $1 below its price when you bought the contract. You purchased the put option when it was $33, and the stock is now $32. Considering that this matches the premium you paid, you won’t have any net loss or profit. That means you break even in the transaction.

Maximize Your Trading Success Today!

You can easily add our calculator to your website. Simply embed it using an iframe, and your users will have access to all its features directly on your site.

<iframe src="https://ao.srv.tlbs.net?lang=en" id="stock-option-calculator" title="Calculator" sandbox="allow-scripts allow-same-origin" style="width: 100%;" frameborder="0" calc-data=""></iframe>

<script>

const calcIframe = document.getElementById('stock-option-calculator');

if (calcIframe) {

window.addEventListener('message', event => {

const allowedOrigin = 'https://ao.srv.tlbs.net';

if (event.origin === allowedOrigin && event.data && event.data.type === 'setDimensions') {

const height = event.data.height;

calcIframe.style.height = `${height + 48}px`;

}

});

}

</script>

Supported languages:

ar, ae, eg, jo, kw, ma, qa, sa, tn, en, gb, us, de, es, fr, id, pt, th, pl, lt, uk, ro, ru, nl, it, zh, lv, vi, et, ko, ms, tr, sr, hr, hi, ja, he, sw, da, sl, el, fi, cs, sv, gd. Specify the code in the "lang" parameter, for example ?lang=de.

<iframe src="https://ao.srv.tlbs.net?lang=en"></iframe>

Success Stories from Our Clients

-

John Anderson

Excellent Tool for Traders

This stock options calculator is a must-have for anyone trading options. It’s straightforward to use and helps me calculate potential profit and loss before making trades. Highly recommended! -

Alex Noon

Accurate and Simple

love how easy it is to input data and get instant results. The calculator gives clear breakdowns of potential returns and risks. A great resource for anyone in the options market. -

Emma Petterson

Perfect for Planning Trades

The site offers an intuitive stock options calculator that lets you predict outcomes quickly. I use it to plan my trades and reduce the risks involved. It’s saved me a lot of time! -

David Lite

A Great Educational Tool

As someone new to stock options, this calculator has been a game changer. It helps me understand the potential risks and rewards, making it easier to make informed decisions. -

Rachel Simpson

Easy to Navigate and Accurate

This site makes calculating stock option values a breeze. It’s very user-friendly, and the calculations are precise. It’s now part of my daily trading routine. -

Alex Caron

Simple Yet Powerful

I was looking for a reliable calculator to estimate my stock options’ value. This one exceeded my expectations with its simplicity and effectiveness. A must for any options trader! -

Sophie Kyle

Highly Efficient

The stock options calculator on this site is incredibly fast and provides all the necessary details to make an informed decision. It’s my go-to tool before entering any trade. -

Emily Siemens

Helpful for Risk Management

I rely on this calculator to gauge the risk-to-reward ratio for my trades. It’s been crucial in helping me avoid bad trades and focus on the profitable ones. -

Michael Lesly

User-Friendly and Detailed

I’ve been using this stock options calculator for a while, and it’s always accurate. It’s so easy to input your option details and get results instantly! -

Chris Howard

Great Resource for Beginners

As a beginner, I find the stock options calculator very helpful. It’s easy to understand and gives me a clear idea of what to expect with my trades. -

Nick Robinson

Essential for Serious Traders

I’ve been trading options for years, and this calculator is an essential tool in my strategy. It simplifies complex calculations and gives reliable results. -

Tom Green

Efficient for All Option Types

Whether you’re calculating calls or puts, this tool handles everything with ease. It’s a fantastic resource for options traders looking to maximize their returns.

FAQ

We hope this covers everything you wanted to know about the stock options average calculator. We’ll answer some more common questions below. If you have anything to add, please don’t hesitate to send us a message!

-

What Is a Stock Options Calculator?

A stock options calculator is a simple but vital tool for investors who purchase call or put option contracts. The utility gives you estimations regarding the potential profit or loss in a particular option transaction. You provide information like the current, strike, and premium price, and the calculator does the math to provide the vital prediction data for that trade.

-

How Can I Track the Best Trades With an Options Calculator?

If you have multiple potential trades, you can easily compare them in the best stock options calculator. By experimenting with different parameters, you can find top trading opportunities. The tool can also show the ratio between risk and rewards as well as points where you could break even. This information is imperative for finding the most attractive option contracts in the market.

-

How Do I Calculate the Stock Option Premium?

A stock options calculator can handle the math for you. All you need to do is enter data like strike price, expiration date, and the number of shares in the tool. The utility will handle all the calculations and display the total premium cost for a particular option.

-

What Is the Difference Between In-the-Money and Out-of-the-Money Options?

If you go with a call option, the stock price going over the strike price means that it’s in the money. If it stays below the strike value, it’s out of the money because you can’t activate the deal. Opposite rules apply to put options. If the stock value is under the strike price, that’s when the deal is in the money. But if the worth remains over the strike value, the deal is out of the money.

-

Is Options Trading Better Than Stock Market Investing?

There’s no better option, as it all depends on what fits your trading style better. However, stock options provide a certain level of flexibility that the conventional stock market lacks. Options provide limited loss risk and offer leverage, and you can even use tools like stock options calculators to learn more about potential deals.

-

What’s the Difference Between Stock Options Volume and Open Interest?

Your stock options volume shows how many contracts you have traded during a particular timeframe. That could be a month, two, or twelve. As for open interest, it’s the list of stock option contracts that still haven’t been closed. That means they haven’t reached their expiration date, or you haven’t chosen to act on them.

Let’s Connect And Ignite Your Success

Ready to take the next step? Contact us today to explore how our innovative strategies can propel your business forward. Our team is here to turn your vision into a reality.

Connect with Ease

Your inquiries, ideas, and collaboration opportunities are just a click away. Let's start the conversation.